Europe Leaders Turning to Bike Industry for Solutions

Frankfurt, Germany

The European bike industry is enjoying unprecedented prominence and relevance among the continent’s top decision makers as, for the first time, the bike sector is being viewed as a central solution to environmental, energy supply and social crisis ,according to Cycling Industries Europe CEO Kevin Mayne.

Speaking at a Eurobike 2022 industry leaders presentation about the sector’s future, Kevin said during his 25 years as a bike industry lobbyist, “this is the first time I’m seeing government officials coming into our room, coming to see me and saying we need you”.

He said those officials are conceding that without the bike industry, they won’t achieve what they need to deliver for Europe.

Unique Potential for Cycling Industry

“We are getting this response because our product is good. We don’t need billions of Euros spent on charging, we don’t need tonnes of hydrogen infrastructure to replace trucks,” he added.

“Every government in Europe is going to need to bounce back and when they do, they just need to remember three words, cycling is essential.”

“The key point is we are ready now, so if you want to kick off a green revolution in Europe, politicians can get that kick-off faster now through cycling.”

Kevin said while the automotive industry is developing its own solutions, “we have to take advantage of being in the lead”.

“I sat in a phone call with the European Commission three or four months ago … and they said to us ‘what are you going to do, how fast can we bring on things like cargo bikes, how fast can we roll out the e-bikes and speed pedelecs because we know they can help to get us out of Russian oil’.

“We did some maths and we think we can take one-eighth of transport oil out. The key point is we are the only industry that can do it now.

“There’s a chance to take the lead in being the kind of industry Europe wants, a green industry, a resilient industry, a sustainable industry.”

“So we said back to them, you invest in the bike lanes, we’ll invest in the bike supply chains but we need to move fast.

“But don’t tell everybody you’re going to put all your money into new hydrogen schemes that are going to be ready in 2028. Put your 10% into cycling, put your 15% in, and tell your member states to do the same.

“Every government in Europe is going to need to bounce back and when they do, they just need to remember three words, cycling is essential.”

Kevin said the European Commission has given the European bike sector six months to develop a single strategy on “everything we know on what grows cycling”.

“It’s something we’ve pushed for for 10 or 15 years, to get the commission to say ‘you are as important as automotive or aviation or rail’,” he said.

“This is when we get the call saying ‘bike industry, you are special to Europe. Would you bring us your expects, sit in this room and be part of our task force.

“There’s a chance to take the lead in being the kind of industry Europe wants, a green industry, a resilient industry, a sustainable industry.

“We are going to get out of Russian fossil fuels, it’s going to happen in Europe, and inside the European plan for saving energy is a whole section on cycling.”

Filling an automotive void

Speaking to The Latz Report after the presentation, Kevin said Europe’s bike industry is perfectly placed to fill a void left by a faltering automotive sector.

“The Euro automotive sector the first time is about to shed 200,0000 to 400,000 jobs. They are mostly in mechanical component manufacturing and assembly because of the arrival of the electric car, and we are a solution to that,” he explained.

“There’s almost a perfect match at the moment. The skill sets and investments they are losing match perfectly with where we are struggling with supply chains.

“That is particularly European because we have retained much more assembly compared to Australia or the US but we can offer that replacement globally.”

German bike manufacturer Corratec recently bought a former car components factory in Romania that supplied Volkswagen.

“They have taken on much of that workforce. And Corratec is not alone,” he said.

“That is playing very well politically to those people who care about jobs and care about green jobs, because if the green jobs are only in biomass, winds and solar, their story suffers that there is an economic success. But when industries like cycling pop up, they can say we’re creating jobs.”

Surprisingly High Job Figures

During a later presentation at Eurobike, CIE and the Confederation of the European Bicycle Industry (CONEBI) announced their survey of bicycle delivery industry revealed it is now employing around 150,000 people.

“If you compare bike tourism business to the cruise ship sector, where are you going to invest your money in the next five years – a sector that is on the up or one that is struggling?”

“We thought there’d be maybe 20,000, 30,000, 50,000 jobs but when we looked at it, we discovered lots of little companies,” he said.

“We worked out this week there are already 150,000 jobs in Europe delivering all things by bike.

“That’s a major industrial sector in its own right but it’s an unknown story. We’re now doing similar research about bike share.”

Kevin said it is a similar story with Europe’s growing bike tourism market, with 10% of tourism in Germany now done by bike.

“If you compare bike tourism business to the cruise ship sector, where are you going to invest your money in the next five years? A sector that is on the up or one that is struggling.

“But if we don’t collect and share that data, then we don’t get than economic narrative happening.

“We want five times more growth than we experienced in 2020. And then we have this exciting Europe where cycling is at the top of the table.”

“We’re getting more sophisticated at sharing our economic narrative and making it work for us.”

Kevin said government in Europe is “seeking support for what they see as a transition. We are saying, view it as a micromobility transition, not an automotive transition”.

He told the leaders workshop the industry needed to be bold and aim to get another 50 million people on bikes.

“We think 50 million more people in Europe could ride bikes than there are today. You think Covid put pressure on your companies. Get over it,” he said.

“We want five times more growth than we experienced in 2020. And then we have this exciting Europe where cycling is at the top of the table.

“We as industry have to do our bit because those people don’t ride if cycling is too hard.

“The e-bike is a game changer and the cargo bike is a game changer but what will we do as an industry to get more women cycling.

“We will not achieve 50 million unless we actually get more women cycling in most countries in Europe.

“We cannot do it unless governments build the infrastructure but as that infrastructure comes, there’s a responsibility on us to deliver more cyclists, and we are doing that well.

“When we do our marketing, we do our advertising, we do our products, we actually own that agenda.

“Everyone has to feel if we share information and work together in working groups, we will be stronger than the automotive industry because we have the right product.”

“We as an industry need to have more than 20% women working in our business if we are going to represent that sector.”

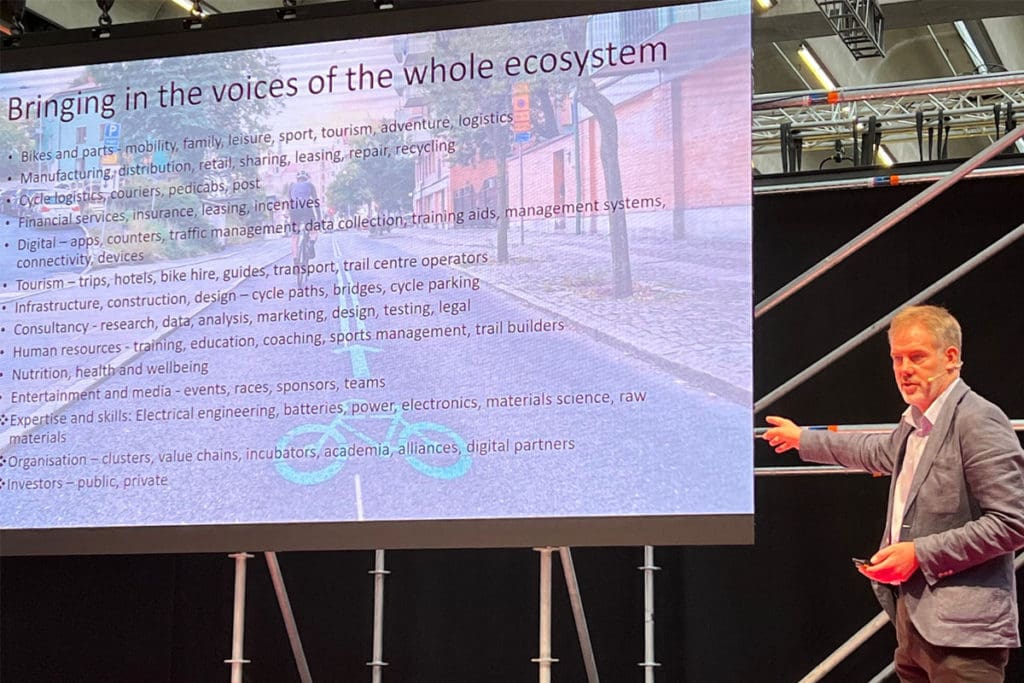

Another speaker at the workshop, Pon Group Director of Future Technology & Public Affairs Raymond Gense, said the bike sector is an increasingly complex ecosystem, with a growing emphasis on selling services, in addition to selling bikes, bike components and accessories.

Raymond said a single, united voice is essential to explain and promote that ecosystem to decision makers.

“If politicians and policy makers hear the same story from everybody, from the producers, from the public sector, from the researchers, then that’s the story they want to act on. This is how politics work,” he added.

“When I entered the bike world some 10 years ago, the first thing I saw that was different from the car industry is (bike companies) were not sharing data.

“The car industry was sharing data on a day-to-day basis because they all benefited from it.”

Raymond said bike companies are now collaborating more effectively to strength the sector but needs to take that cooperation to a higher level.

He said the sector comprised many large and proud organisations, but also a proliferation of small companies.

“Everyone has to feel – the big ones and the small ones – if we share information and work together in working groups, we will be stronger than the automotive industry because we have the right product.

“The automotive industry had the right product.”

He said the automotive industry has always been strong because it promised jobs for Europe.

“Now we are promising jobs and we are quantifying this and this is a big change.

“We were never seen by the European Commission as a jobs machine and this is what it is now.”