Hard Times for Some Bike and Scooter Share Companies

It appears that there is a consolidation happening, or ‘culling’ if you prefer a more brutal description, in the global bike and scooter share market.

Bird’s global struggles have impacted it’s Australian operations, which as we reported here appear to have ceased, although the company has not responded to our request for confirmation. But since then came news reported by Inc.Australia that Bird filed for Chapter 11 bankruptcy protection in the USA state of Florida on Wednesday 20th December.

A statement from Bird said that their service in 350 cities worldwide would continue to operate, subject to court approval. At one stage Bird had a market valuation exceeding US$2billion (A$3.03 billion). You can read the full article including a range of problems and issues that may have led to Bird’s current situation, here.

Other Share Scheme Operators Have Their Wings Clipped

As reported on TechCrunch in late December 2023, Micromobility.com, formerly Helbiz, was delisted from the Nasdaq on Monday 18th December as a result of the company’s noncompliance with the stock exchange’s listing rules, according to a regulatory filing.

Micromobility.com was kicked off the stock market for failing to maintain a share price of at least US$1 (A$1.51) and for failing to comply with Nasdaq’s minimum stockholders’ equity requirement for continued listing.

The company’s stock has struggled to remain in compliance since going public via a SPAC (special purpose acquisition merger) in 2021. In March, the company issued a reverse stock split to bring the price back into compliance, the gains from which didn’t last long. Micromobility.com also recently said it intended to seek approval for another reverse split at a special meeting of the stockholders scheduled for January 2024. That meeting has been postponed, as has the move to do another reverse split.

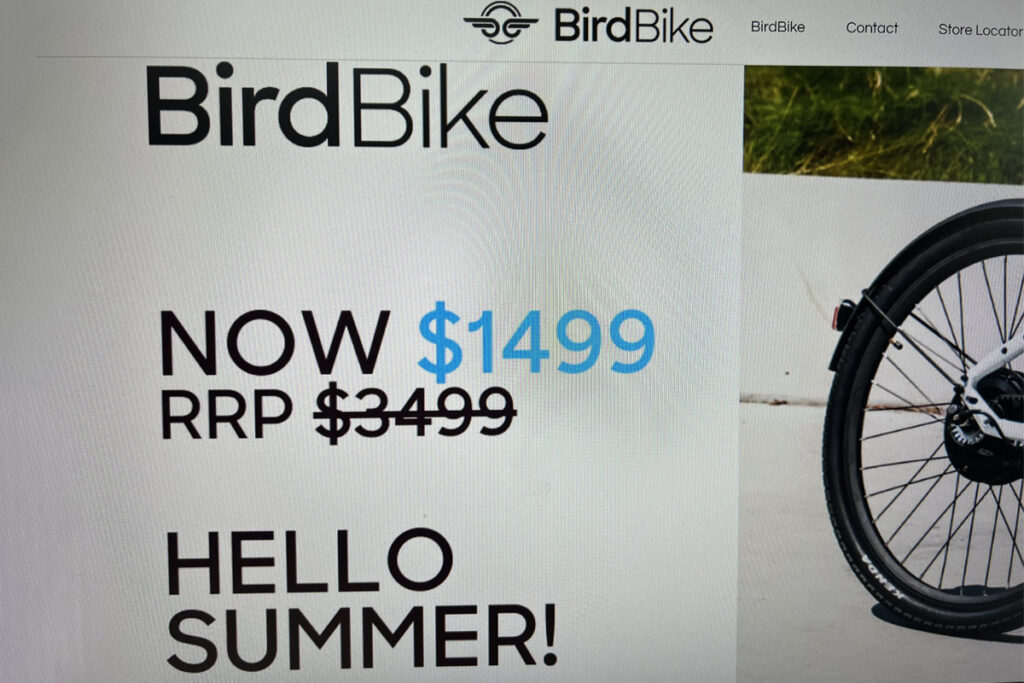

Micromobility.com says its transition to OTC markets (a much smaller exchange than the NASDAQ) will “have no effect on the company’s business or operations.” The startup’s rebrand aimed to encapsulate a push toward retail — Micromobility.com opened its first brick-and-mortar store in SoHo, New York City in September 2023 and has an e-commerce site featuring a small selection of e-scooters, e-bikes, helmets and water bottles.

The startup’s earnings show a company that brought in US$1.5 million (A$2.26 million) in revenue in the third-quarter at a net loss of US$9.5 million (A$14.3 million). The balance sheet also shows that Micromobility.com’s liabilities, at US$61.7 million (A$93.1 million), vastly outweigh its assets, at US$9.4 million (A$14.2 million).

Micromobility.com’s delisting comes as the shared micromobility industry finds itself in turmoil. Superpedestrian shut down during the third week of December and is exploring the sale of its European business. Tier Mobility in November issued its third round of layoffs this year, after selling off Spin to Bird a couple months earlier.

Shared Micromobility Still Growing Overall

Despite these companies struggling, one analyst is predicting that the world bike and scooter share fleet will grow from 25.3 million vehicles to 38.2 million by 2027.

According to a market research report from the IoT (internet of things) analyst firm Berg Insight, the micromobility market has been characterised by rapid growth, a high pace of merger and acquisitions, and many shutdowns of services during the past few years.

“The market is now reaching a more mature stage and operators are generally more focused on reaching profitability, which was not the case in previous years,” said Martin Cederqvist, IoT analyst at Berg Insight.

The majority of the current and expected expanded share fleet is in a single country – China – although the report does not give a break-down of predicted growth by country.