Bike and Scooter Share Ridership in North America Hits All Time High

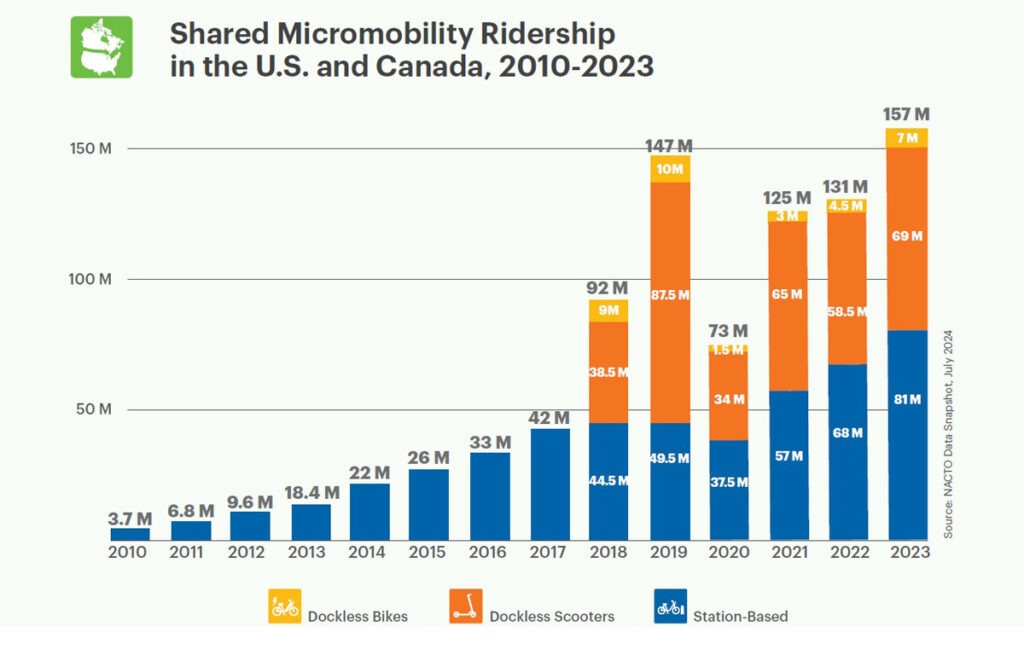

Australia is not the only place where bike and scooter share has been growing strongly. All three modes of bike and scooter share: dockless bikeshare, docked bikeshare and scooter share, grew strongly in 2023 across the USA and Canada.

Total trips on shared micromobility increased by 20% from 2022, surpassing the pre-pandemic 2019 peak of 147 million trips across both countries. People took 133 million trips on shared micromobility in the U.S. and 24 million trips in Canada. Shared micromobility trips in Canada increased by a whopping 40% in 2023, due to the continued expansions of station-based systems and the introduction of dockless e-scooters into new markets. Trips in the U.S. increased by 16% in 2023, driven largely by the continued growth of e-bike trips on larger station-based systems.

E-bikes are powering much of the growth. Trips on e-bikes grew from 20 million trips in 2022 to 28 million trips in 2023—a 40% increase. E-bike trips accounted for 46% of all station-based bike share trips made in the U.S. in 2023, and e-bikes represented a third of the total station-based bikes available. Trips on station-based pedal bikes decreased very slightly to 32.5 million trips in 2023, from 33 million in 2022, coinciding with a decreasing percentage of pedal bikes in station-based systems.

In looking at the average number of trips taken per device per day, e-bikes are used significantly more than pedal bikes in systems that offer both. In Los Angeles, e-bikes were ridden nearly 8 times more than pedal bikes, and in New York City, nearly 4 times as much. Los Angeles quadrupled the number of e-bikes available between 2022 and 2023, from 7% to 16% of the entire fleet (which also grew). As a result, trips on e-bikes nearly tripled from 87,000 trips in 2022 to 232,000 trips in 2023.

All of the above data comes from the NACTO (National Association of City Transport Officials) Shared Mobility in the US and Canada report published in July 2024.

Despite the rapid growth of all three forms of shared mobility, the report cites two main dark clouds on the horizon that could limit further growth.

One is the high price of rides, particularly for casual users, with many schemes increasing their prices. Most bike and scooter share schemes in North America are privately owned and therefore need to be profitable to survive.

Secondly, the report cites the lack of investment in suitable infrastructure by the host city authorities.

If these two issues can be addressed, there’s no reason to doubt that shared micromobility ridership will continue to grow rapidly for the foreseeable future.