Velosure – Boosted Coverage for eBikes

– Sponsored Content –

It may come as a surprise, but many home and contents insurance policies won’t cover the theft of an e-bike as they would a regular bicycle. Many cycling-specific policies won’t cover e-bikes either.

Ebike popularity is booming but this situation means there’s a rapidly growing group of bike owners who can’t get coverage for their property. It’s a major concern, especially when e-bikes are more likely to be put to task in utilitarian applications where they’ll be left locked up but unattended; you may be doing the groceries, commuting to work, dropping into the post office or many other day-to-day tasks. It’s an unfair situation, especially when assisted bikes cost substantially more than their non-assisted equivalents.

Recognising this inequity, Velosure (part of the global Two Three Bird insurance company) quickly adapted to the trend to ensure that e-bikes were covered as part of their insurance offerings. This applies to electric pedal-assist bicycles not exceeding 250 watts that have a maximum assisted speed of 25kph. To be covered, the bike needs to be purchased as a factory-supplied electric bicycle as opposed to a retrofitted kit.

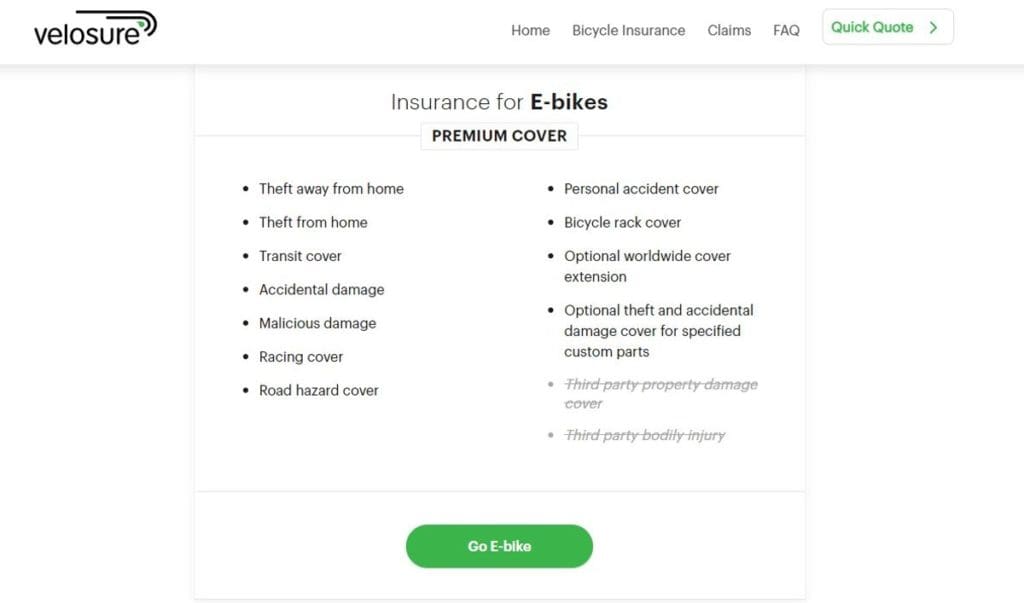

The average value of the e-bikes protected by Velosure is around $6,000, and in many cases, they serve as a substitute for a car or motorbike, so it makes sense to seek out a comprehensive insurance policy. Velosure e-bike coverage includes theft both from home and away from home (as long as the bike is secured by an approved lock), along with cover for accidental damage.

They also cover e-bikes against damage whilst being transported on a bike rack and offer an optional extension for overseas travel and custom bike parts. There’s even an element of personal injury cover and coverage at competitive events (as with any insurance the PDS should be read for the terms and conditions).

For easy and instantaneous insurance, you can sign up for 30 days of complimentary insurance under Velosure’s ‘New Bike Day Program’. This provides the majority of the benefits of their premium e-bike coverage with protection against theft, damage, transit cover and even coverage while racing. The only thing it lacks is the optional worldwide cover extension.

Sign up for New Bike Day Program prior to leaving the store and get peace of mind from the knowledge that your pride and joy is protected.

To find out more about New Bike Day insurance and their other packages, check out www.velosure.com.au or contact Velosure directly on 1300 110 048.

Why wouldn’t retrofitted bikes qualify for this insurance? They can be made just as road-legal as those made in Chinese factories. And in many cases, will be of much higher quality and utility (particularly if fitted by professionals). I find this confusing and unfair. What’s the rationale?